Shop by Category

Shop by Brand

Unlock the Secrets of the Stock Market – Even If You’re a Complete Beginner!

Are you curious about the stock market but don’t know where to start? Stock Market Basics: A Beginner’s Guide to Investing & Trading is your no-fluff, straight-talking introduction to the world of shares, indices, and intelligent investing. Whether you’re looking to build wealth, create a side hustle, or just get a grip on the financial news, this book breaks down everything you need to know in plain English- no jargon, no hype.

- Learn how the stock market works.

- Understand different types of assets, orders, and strategies

- Discover the power of compounding, risk management, and diversification

Written for Australian and global readers alike, this is the perfect starting point for your investing journey. If you've ever said, "I wish someone would just explain this clearly," this book is for you.

1. The Stock Market: A Marketplace for Buying and Selling Ownership

4. How Are Share Prices Determined?

7. Why the Stock Market Matters to You. 14

5. Choosing the Right Asset for You. 23

6. Risk vs. Reward in Different Assets. 23

4. Price & Movement: The Basics. 26

5. Volume: Trading Activity. 26

6. 52-Week Range: Context Matters. 26

7. Market Capitalisation (Market Cap). 27

8. Dividend Yield: Income from Shares. 27

9. PE Ratio & EPS (More in Chapter 7). 27

1. What is Fundamental Analysis?. 33

2. Qualitative vs. Quantitative Analysis. 33

3. Key Financial Statements Explained. 34

4. Popular Fundamental Ratios and What They Tell You. 35

5. How to Perform Basic Fundamental Analysis (Step-by-Step). 35

6. Tools & Resources for Beginners. 36

7. Limitations of Fundamental Analysis. 36

Chapter Wrap-Up. 36

Chapter 7: Introduction to Fundamental Analysis. 37

(With Examples from ASX and Global Companies). 37

Introduction.. 37

1. What is Fundamental Analysis? 37

2. Quantitative vs. Qualitative Analysis. 37

3. Financial Statements: Key Sections to Know... 38

4. Core Financial Ratios (With Examples). 39

5. Step-by-Step Fundamental Analysis. 39

6. Tools You Can Use (For Free or Low-Cost). 40

7. Strengths & Weaknesses of Fundamental Analysis. 40

Chapter Wrap-Up. 40

Chapter 8: Introduction to Technical Analysis. 41

(Reading Price Charts and Spotting Opportunities). 41

Introduction. 41

1. What is Technical Analysis? 41

2. Types of Charts Used. 41

3. Price Trends: The Backbone of Technical Analysis. 42

4. Support and Resistance Levels. 42

5. Technical Indicators for Beginners. 42

6. Chart Patterns to Know... 43

7. Timeframes & Trading Styles. 44

8. Combining Technical & Fundamental Analysis. 44

Chapter Wrap-Up. 45

Chapter 9: Risk Management Essentials. 46

(Protecting Your Capital and Staying in the Game). 46

Introduction. 46

1. Why Risk Management Matters. 46

2. Position Sizing: How Much to Risk per Trade. 46

3. The Importance of Stop-Loss Orders. 47

4. Risk/Reward Ratio: Is the Trade Worth It? 47

5. Diversification: Don’t Put All Your Eggs in One Basket. 48

6. Avoiding Overtrading and Greed.. 48

7. Have a Trading Plan. 48

8. Managing Open Positions. 49

9. Accepting Losses Gracefully. 49

Chapter Wrap-Up. 49

Chapter 10: Creating Your First Trading or Investing Plan. 51

Turning Knowledge into Action. 51

Introduction. 51

1. What Is a Trading or Investing Plan? 51

2. Define Your Objective. 51

3. Determine Your Style. 52

4. Choose Your Market and Instruments. 52

5. Define Your Entry and Exit Criteria. 52

6. Position Sizing and Risk Management53

7. Tools and Platforms You’ll Use. 53

8. Emotional Discipline Rules. 53

9. Review and Update Your Plan. 54

10. Sample Template: Starter Trading/Investing Plan. 54

Chapter Wrap-Up. 54

Chapter 11: Common Mistakes to Avoid. 55

Learning from the Missteps of Others. 55

Introduction. 55

1. Trading Without a Plan. 55

2. Risking Too Much on One Trade. 55

3. Failing to Use Stop-Losses. 55

4. Chasing the Hype. 56

5. Ignoring Risk/Reward Ratios. 56

6. Overtrading. 56

7. Letting Emotions Drive Decisions. 56

8. Not Diversifying. 57

9. Ignoring the Big Picture. 57

10. Not Reviewing or Learning from Trades. 57

Chapter Wrap-Up. 57

Chapter 12: Next Steps & Staying on Track.. 59

Building Momentum for Long-Term Success. 59

Introduction. 59

1. Begin with a Small, Real-Money Account. 59

2. Track Everything You Do. 59

3. Build a Weekly Routine. 60

4. Keep Learning — But Avoid Overloading. 60

5. Join a Community. 60

6. Celebrate Small Wins. 60

7. Revisit Your Plan Quarterly. 61

8. Stay Grounded During Market Highs and Lows. 61

9. Set Long-Term Financial Goals. 61

10. Remember: This is a Journey. 62

Chapter Wrap-Up. 62

Final Thoughts from the Author. 62

Back Cover Copy. 63

Recommended

-

-

-

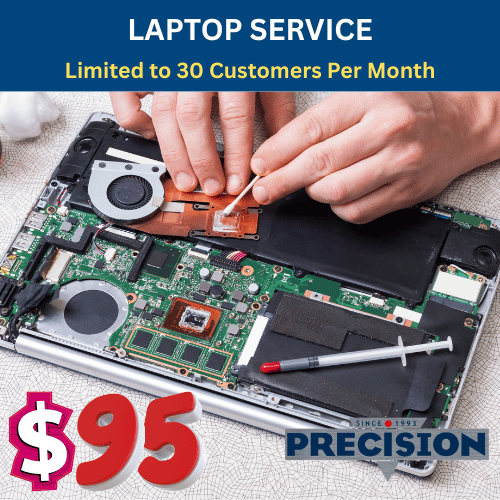

Laptop & Notebook Service | $95 | Book Online

MSRP:Was:Now: $95.00 -

Desktop Computer PC Service | $95 | Book Online

MSRP:Was:Now: $95.00 -